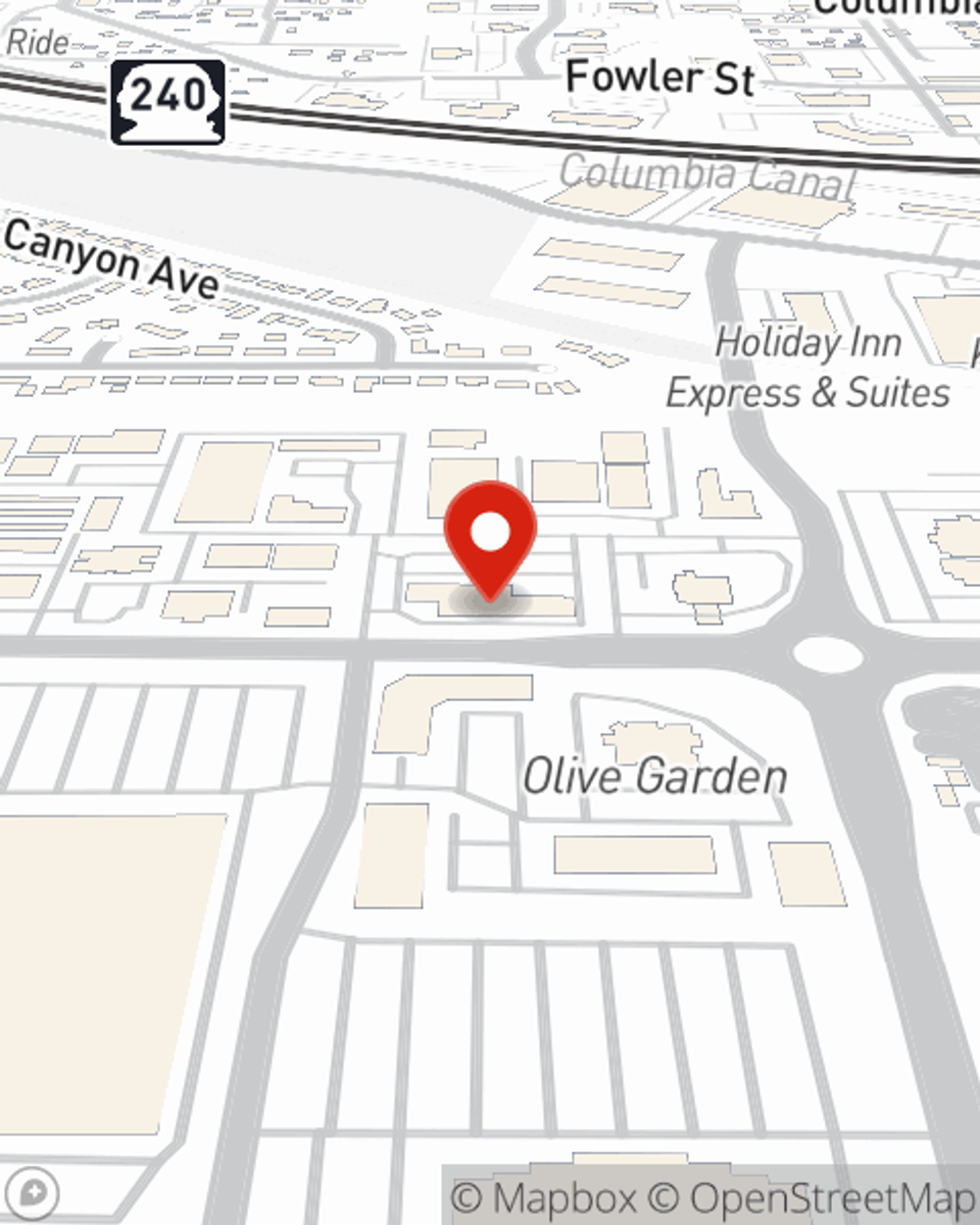

Business Insurance in and around Kennewick

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

When you're a business owner, there's so much to consider. You're not alone. State Farm agent Chad Ward is a business owner, too. Let Chad Ward help you make sure that your business is properly protected. You won't regret it!

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your wages, but also helps with regular payroll costs. You can also include liability, which is important coverage protecting your business in the event of a claim or judgment against you by a third party.

Call or email State Farm agent Chad Ward today to find out how a State Farm small business policy can ease your worries about the future here in Kennewick, WA.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Chad Ward

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.